Proud Sponsor of the 54th Annual Boys & Girls Club of Santa Cruz Golf Tournament Putting Contest!

Excited to share that I’m sponsoring the Putting Contest at the 54th Annual Boys & Girls Club of Santa Cruz Golf Tournament on July 11th!

This event is the Club’s largest fundraiser of the year, and their goal is to raise $75,000 to support the amazing programs they provide for local youth—everything from academic enrichment and leadership training to safe spaces after school.

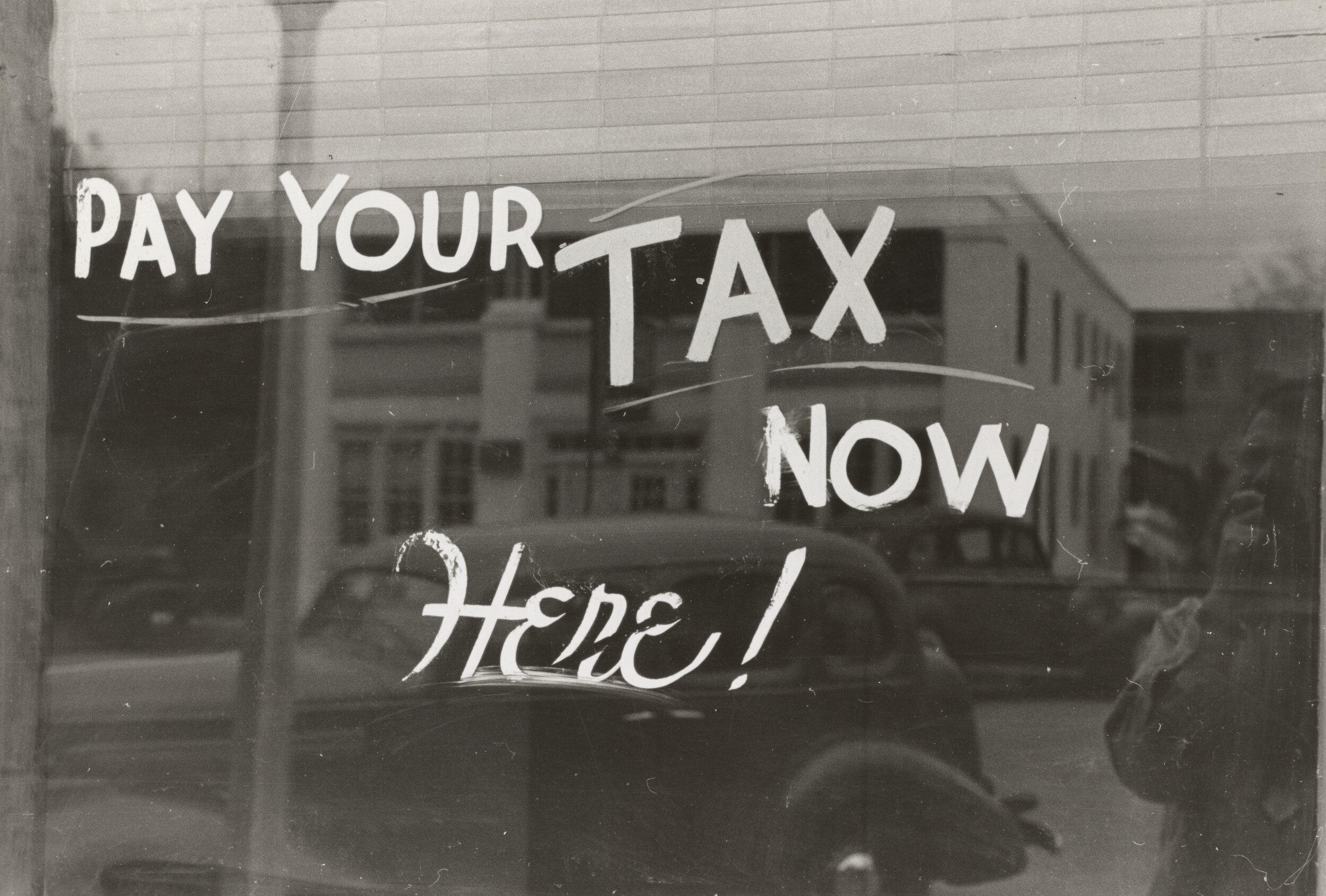

How to make business tax payments online

Paying your business taxes online is quick and convenient. For federal taxes, use the IRS EFTPS system to make payments for balances due, estimated taxes, or extensions. You'll need to enroll first, but the tool is free and easy to use.

For California state taxes, use FTB Web Pay Business. Choose your entity type, enter the required information, and select the applicable tax year and payment type. Both platforms allow you to securely schedule payments and save confirmation receipts for your records.

Read more below for detailed instructions on making your federal and state tax payments.

2024 Firm Updates

We’ve made some exciting updates, including transitioning to a new client portal, adding new team members, and adjusting our fees. Read more below!

Year end considerations

For most things in the tax world, once the clock strikes midnight on December 31st, your chance to change your tax position for the year ends. It’s one of those things where, come March or April, you vow to do better next time. But life gets busy, circumstances change, and tax planning often falls off the radar.

Big Changes! Announcing DCI Accounting Group

Big news! As I look to the future and plan for the company’s growth, I’ve realized that achieving this vision requires partners. To better focus on our business offerings and bring in the human and financial capital needed, we have restructured the business. We are excited to introduce the DCI Accounting Group, now serving the accounting, payroll, HR, and temporary CFO needs of our clients.

Where’s my refund?

“Hey, where’s my refund?” — It’s the question on your mind when you’re expecting a refund and want to know how soon you’ll receive your funds. Read on to learn how to find the answers you need.